The Flaws in Industrial Capitalism

Every significant society in the world today is using an industrial capitalist model for their economy. Industrial capitalism is a flawed version of the capitalist economic model that only maintains its validity under certain, specific conditions:

- A swollen productive demographic

- The availability of exploitable resources

Demographic Balance

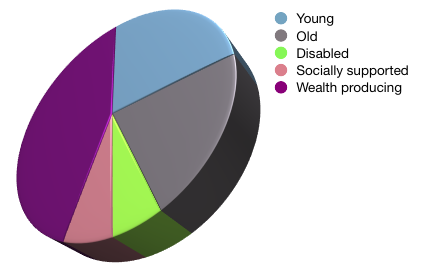

Until now all of the societies that have hosted capitalist economic systems have done so with pre-prosperous demographics; in such a society the proportion of the population that is a net producer of wealth (neither too young, too old nor disabled) is a majority. Once a society has introduced modern medicine and achieved a level of prosperity, two changes to the demographics cause an important change to the proportion of net wealth producers to net wealth consumers: extended life expectancy and increased educational requirements. The increase in average life expectancy has the most impact, changing the percentage of the elderly and disabled from single digits up to around 25%. The increased educational requirements to be a functional member of a prosperous society push the first productive years of the average adult up from the mid-teens into the mid-twenties, with a commensurate increase in the percentage of not-yet-wealth-producing youth.

Until now all of the societies that have hosted capitalist economic systems have done so with pre-prosperous demographics; in such a society the proportion of the population that is a net producer of wealth (neither too young, too old nor disabled) is a majority. Once a society has introduced modern medicine and achieved a level of prosperity, two changes to the demographics cause an important change to the proportion of net wealth producers to net wealth consumers: extended life expectancy and increased educational requirements. The increase in average life expectancy has the most impact, changing the percentage of the elderly and disabled from single digits up to around 25%. The increased educational requirements to be a functional member of a prosperous society push the first productive years of the average adult up from the mid-teens into the mid-twenties, with a commensurate increase in the percentage of not-yet-wealth-producing youth.

The percentage of net wealth producers in a successful and peaceful society with a prosperous economy falls below 50%. This change in demography occurs naturally and unavoidably[1] .

Exploitation

The availability of human and material resources that can be exploited at below their real cost can allow a society with an industrial capitalist economy to continue deluding itself into believing that a tax on the wealth economy will be sufficient to meet the social needs to the society, so long as those resources remain exploitable. If materials can be extracted and used without their external costs being paid, or if labour can be utilized without proper compensation, the industrial model allows those “ghost costs” to be converted into “wealth” in the form of profit. But those profits are illusory and will be absorbed when the true costs return and require recognition. Taxes on that ghost wealth are used to pay for services to the population, making it look like the books are being balanced in the exploiting society.

All of the developed, industrial societies today have been built on the exploitation of resources, and this has led to a host of contortions and corruptions in both economic and foreign policy in the name of appropriate self-interest. The rapidly arriving demographic pressures in industrial capitalist economies has increased domestic justification for exploitation while increasing the competition for access to exploitable resources, a process that is shortening the longevity of all exploitation.

The eventual arrival of the true costs for any resource use mitigates the length of time that exploitable resources remain available. The costs in these situations are real, and they do have to be borne at some point in time. For instance, it is possible to create toxic waste at the point of production without paying for it, but the cost of cleaning up does have to be carried eventually. Similarly, it is possible to exploit human labour at below true cost for a while, but those costs are only avoided and will have to be borne eventually, unless the population is oppressed or enslaved.

In the case of human resources, the barest increase in the prosperity of a population dramatically increases awareness, and this rapidly creates demand for full compensation. The only way to suppress the true cost of human resources in the medium term is to oppress them, and even that strategy has a finite longevity in our modern connected world. Recent experience in developing societies in Asia suggests that human exploitation has a 20 to 30 year maximum span before changes in the society force rises in compensation.

In the case of natural and material resource exploitation the return of true costs can be extended for longer, in the region of 100 years; but eventually these costs do manifest, as we are seeing with climate instability.

Exploitation has been a feature of most human civilizations to date, which lends it a certain justification for those inclined to find such; but as the world gets ‘smaller’ and the effects of exploitation anywhere impact the lives of everyone everywhere, it is increasingly impractical as a basis for economic prosperity in any single society.

In any case, the exploitation of any resource is, by definition, not sustainable; and in developing a model for our future prosperity we must assume that exploitation is not available as an option.

Total Economic Awareness

The industrial capitalist model assumes that all activity is economic in nature (Total Economic Awareness (TEA)), and that any social needs will be paid for by a tax on the wealth of the economy. In other words, that we all live in an economy first and foremost, and that portion of activity that is not engaged in commercial production (social need) is a necessary but minority adjunct to the wealth producing economy. In this frame, the social service requirements of the population are to be incorporated as far as possible into the commercial economy (“privatization”), and where that is not possible the costs can be borne as a burden on the economy in the form of taxes that are then used to pay for the social services. The job of politicians, in this model, is to arbitrate just how much of a drag on the economy we wish to tolerate in order to provide social services.

The fallacy of industrial capitalism’s TEA framework is exposed as the society matures to a naturally balanced demographic, with less than 50% of the people producing more wealth than they are consuming. At this point the fact that commercial, wealth-creating activity is actually a subset of all activity, and that most activity is actually social in nature, becomes inescapably evident. This is where most of the advanced industrial economies of the world are today, and it is becoming obvious that a reasonable tax on commercial activity cannot generate sufficient money to “pay for” the social needs of the population. The reality that industrial capitalism has been blind to, comes home to roost; and it faces either bankrupting its wealth economy with unsustainable taxes to meet its social needs, or ignoring its social needs and destroying the fabric of the society that supports it. There is no way out of this: the economy is a client of, and a subset of the total activity of, the society that hosts it.

The Consequences of Industrial Capitalism

As a result of continued adherence to an industrial concept of the role of an economy, brought about by subscription to TEA and supported by unbalanced demographics and the availability of exploitable resources, there are consequences currently arriving at the doors of today’s industrialized societies:

- Fiscal imbalance (budget deficits) caused by rising social costs.

- The rising costs of healthcare, pensions, elder care and education are exceeding the revenues available from a reasonable tax on the wealth economy, so societies across the world, through their governments, are borrowing to fund the cost of the needed social services.

- Infrastructure depreciation due to lack of investment, at exactly the time when massive infrastructure investments are required to meet the challenges of climate instability and the transition to renewable energy sources.

- Initial shortfalls in the tax revenues required to meet the social needs of advanced industrial capitalist societies was absorbed by reducing investment in and maintenance of infrastructure. Various attempts to move these infrastructure costs to the wealth economy through the “privatization” of public assets has failed to yield increased investment because core infrastructure projects are so large that they dwarf the ability of any private commercial entity to fund or manage them, and the return on the investment is over such a long term that private equity cannot meet the need.

- Inflated nominal costs that are distorting labor markets and inflating the nominal costs of the infrastructure projects necessary to mitigate climate instability and provision renewable energy sources.

- The TEA manifest in industrial capitalism leads to the creation of minimum monetary compensation regulations in an attempt to meet the social needs of its participants. This distorts the labour market and increases nominal costs for business which have to use wealth to satisfy social needs; leading to massive under utilization of available labour, decreased flexibility for businesses and workers, and stifled innovation.

- Attempting to use wealth to satisfy the social component of labour costs inflates the nominal cost of labour making large scale projects, such as infrastructure, seem even more expensive than they are. This discourages undertaking the projects in the first place.

- Paralysis of monetary management caused by the use of monetary instruments to provide social security, threatening the stability of the global capital structure.

- The massive sums stored in pension and other social security purposed financial instruments has made it politically untenable to allow wealth destruction that affects those instruments, blocking the functioning of a key mechanism for the health of a functional capitalist system. Instead of recognizing the destruction of capital (such as with the collapse of asset bubbles) corporations, bankers and politicians collude in the maintenance of money supply at above the level of real wealth.

- Governments are required to raise huge sums on the capital markets to finance their budget deficits, much of this borrowing is from the money set aside as savings for social security (pensions). The incestual nature of this financial arrangement encourages governments to engage in financial accounting manipulation as well as risk deferment and concealment.

- Central Bankers, who should be an importantly independent institution in a functional capitalist system charged with maintaining the value of the currency, are trying to keep the house of cards from imploding by using ever more complex accounting mechanisms designed to establish the future credibility of increasingly massive current debts. Precluded from providing honest appraisal of the total wealth in the economy, they cannot make effective use of money supply controls, thereby risking the mutual consent on which the entire system rests.

- Corruption of corporate governance, caused by massive flows of capital into investment instruments used as a store for future social security, leading to runaway executive compensation untied to performance.

- Huge investment funds managed by small groups of disengaged professionals dominate the shareholdings of major corporations. The fund managers are only concerned with return on capital and can move their investments at will from one corporation or asset to another. The fund managers do not contribute to the running of the businesses because they are disengaged and have only a passing interest in the workings of the business, so they rely on executive managers to generate the maximum return from the businesses in the short term. This elevates the role of the executives who can maximize short term profits and creates a culture that rewards financial accounting manipulation as well as risk deferment and concealment.

- The prerogative of the investment funds to maintain their value, because that value represents the social security of the society, adds to the pressure on the entire system (the corporations, their executives, the bankers and the politicians) not to recognize wealth destruction.

- Economic instability brought on by the imminent return of the previously unrecognized costs of exploitation .

- Deferred and concealed costs (“ghost costs”), that are known but as yet unrecognized, lurk in the wings awaiting recognition and threatening return as the result of some unforeseen event. These ghost costs cause instability in markets as players bet on their arrival or further deferral. Examples of these “ghost costs” include social unrest in oppressed and exploited populations, climate events caused by climate instability and swings in the costs of raw materials due to changes in the political leadership of origin nations.

- The most significant deferred costs at this time are the costs associated with mitigation for climate instability and the transition to renewable energy sources.

- Fraying of the social fabric caused by massive income and wealth inequality resulting from an overweight investment industry.

- As an advancing industrial capitalist society builds up ever greater reserves of capital assets in the form of savings to meet future social costs, the inertia behind corruption of money supply rectitude and corporate governance, as well as the continuous deferment of ghost costs, builds up; resulting in ever greater income disparities between those charged with the maintenance of the delusion (very important jobs that are valued highly by the current holders of wealth) and those experiencing the reality of the delusion (due to the failure to actually provide social security).

- Corruption of the political system stimulated by inappropriate cost structures and labour provisions foisted on the commercial economy, in an attempt to try and deliver social security inside the framework of an industrial capitalist economy.

- Because a democratic industrial capitalist economy is forced through the democratic process to meet some social needs, it does so within the TEA frame by imposing conditions on the labour market, such as minimum wages and required benefits packages. These legislative manipulations of the labour market encourage businesses to act politically to defuse the impact on their particular operations, and they do so by using their wealth to restrain the political process from interfering in their business interests.

All of these consequences are appearing, and many are fully maturing now. They threaten the integrity of the industrial capitalist economic model and, given their natural and inexorable arrival, it is incumbent on us to review what is failing, determine the reality of the situation and develop alternatives that conform to the nature of the planet and its populations.

We have both the need and the opportunity to replace our industrial economic model with a sustainable economic model in the very short term. Conformance with the natural shape of our populations, the natural resources available on our planet and the nature of our human character are all vital foundations for any model that lays a claim to sustainability. Using these guiding lights and a keen analysis of what is working, and what is not working, in today’s economies we have fashioned a sustainable economic model that is accessible, practical and achievable.

The Internal Inconsistencies of Industrial Economics

Recognizing Destruction

Industrial economics leverages the ability of fiat currency to allow the recognition of wealth at the point of its creation, and so enable the rapid creation and dissemination of wealth. However a fiat currency is dependent on effective management of the money supply to avoid the perils of inflation, and effective management of money supply requires that both the creation and the destruction of wealth are recognized. Our industrial economies have failed to understand the crucial distinction between the monetary economy and the hygiene economy, so we have tried to store social security in monetary instruments, and that has led to restrictions in the ability to recognize wealth destruction. Because the basic well-being of an industrial society is dependent on the preservation of wealth, for instance the value of pensions, it becomes politically and socially impractical to recognize large destructions of wealth – a symptom that has come to be called “too big to fail”, referring to wealth institutions operating in the wealth economy but whose destruction would cause irreparable harm to the social fabric of the society within which they operate.

Recognizing Wealth

The other fundamental internal inconsistency of the industrial economy is the improper recognition of wealth, again a symptom of the basic failure to recognize the difference between the wealth of hygiene economies. In fact it is a precept of the industrial economy that everything can and should be valued in monetary terms. This false premise leads to an attempt to value non-wealth generating activity with wealth-significant currency. In reality there is much normal and valuable activity in a society that is not wealth generating, such activities simply satisfy the hygiene needs of the society. The industrial economy’s total economic awareness (TEA) fixation results in the attempt to use wealth-significant currency as compensation for non-wealth creating activity, and so pollutes the wealth significance of the currency. This inconsistency has two negative impacts that make the industrial economy unsustainable:

- the elevation of nominal costs

- the contamination of money supply management that is so vital to a fiat currency economy.

Nominal Cost Inflation

Elevation of nominal costs expressed in monetary (i.e. wealth significant) terms results from the inclusion of hygiene (non-wealth significant) costs in the price of goods and services. The most important de-sustaining impact of this inconsistency is to inflate the nominal cost of infrastructure investments, making investments that are necessary to transition to a renewable energy system seem even larger than they are. This cost inflation gets more pronounced the more deeply entrenched the industrial economic model is in the society, because a higher portion of hygiene costs get converted into monetary costs.

The Demographic Dependency of Industrial Economics

While industrial economics incorporates some awareness of the need for social fabric, it does so solely as an adjunct to total economic awareness and attempts to incorporate social costs within the framework of the wealth economy. This fundamental flaw in the long-term sustainability of industrial economics does not become apparent until the natural demographic balance, that results from increased prosperity, manifests.

While an industrial economy has a swollen productive demographic the cost of social fabric maintenance at a level that avoids social dissolution appears to be containable within a reasonable tax on the activity of the wealth economy. But as the effects of the prosperity generated filter into the society, in the form of extended life expectancy and more extensive educational requirements, the proportion of the population engaged in wealth-generating activity falls from a peak of 80% to less than 50%, and this places an unbearable burden on the wealthy economy that cannot be met with a reasonable tax. Inevitably an industrial economy finds itself faced with a choice of wealth diversion or social breakdown, either path being ultimately self-destructive.

In an intermediate stage, as found in the most advanced industrial economies of this time, vast amounts of wealth are sequestrated into monetary reserves in an attempt to preserve a store of wealth to meet known and future social costs, these are commonly known as Social Security accounts and pension funds. Ironically the storage of wealth in these monetary silos corrupts the basic tenants of the monetary system because they make the recognition of wealth destruction socially unacceptable, and they stimulate commercial investment activity with disengaged participants who rely on the self-interest of management to guide the decision-making strategy for the commercial entities they invest in. The purposeful construction of corporate governance, that is designed to ensure that shareholder interest in the long-term (i.e. the sustainable success of the corporation) is prioritized above the short-term interests of individuals, is dissipated and corroded. The accumulation of communal wealth in concentrations managed by small groups promotes disengagement, corruption and betrays the sophisticated attention on which real wealth creation in a competitive, innovation intensive, market economy is dependent.

So the natural demographic balance that is the result of a successful economy both bankrupts and corrupts an industrial economy because it does not recognize the distinction between the wealth and hygiene spheres of activity.

The Industrial Economic Model’s Exploitative Dependency

Exploitation not an inherent feature of a capitalist market economy, rather it is a characteristic of industrial economics. Industrial economics is simply the maladjusted implementation of what is a perfectly natural mechanism manifested in a competitive market economies. The exploitative nature of industrial economics stems from the failure to accurately attribute costs, often arising from a failure to recognize true costs, and sometimes from a deliberate practice of avoiding the recognition of true costs.

While Marx may have been prescient in recognizing the human tendency for shortsightedness as a potential, and even likely, fundamental flaw in the practice of market capitalism, it is important to distinguish between failures of implementation and the quality of the mechanism. If the mechanism is inherently natural it must be accommodated in the framework of practice, otherwise it will continue to operate external to the framework and invalidate any assumptions upon which the framework is based. The mechanism of resource allocation determined by competitive market activity is a natural system and cannot be ignored in the construct of a sustainable economic model. As a corollary to the market system it is equally important to achieve the most accurate and comprehensive cost incorporation possible, without this prerogative the market system will naturally exploit unrecognized and unaccounted cost.

There are many exploitative relationships in the current practice of industrial economics but they can mostly be distilled into two categories: human and Nature. Human exploitation is the use of human resources that can be employed without sufficient compensation to provide for a healthy, sustainable life standard. Nature exploitation is the use of natural resources without accounting for the cost of repairing damage caused by their extraction, use, or consequent waste. Because both categories of exploitation are possible, it is only through the deliberate implementation of policies that seek to ensure accurate cost accounting that these flaws can be addressed. While an inclination for justice is sufficient motive to address these exploitations, there are also vital economic reasons for doing so. The very concept of unaccounted costs contains the acknowledgement that there are real costs that are being avoided. This means that those costs will be borne at some point, and if they are not included in the activity that exploited their avoidance then they will have to be carried by another process at a different time. When the costs are incurred they will destroy wealth, so the initial wealth created by the exploiting activity is effectively creating “ghost wealth” that inaccurately inflates the money supply and corrupts the efficient operation of markets for resource allocation.

The particular problem that we face today is that the cost overhang from resource exploitation is threatening to rise to such a level that it will exceed the capacity of all human activity for repayment, and the total of the wealth destruction would effectively wipe out the entire store of wealth amassed by the history of human civilization. The fact that industrial economics has allowed this to develop is the primary article in the mandate for its termination and replacement.

So the flaws in industrial economics can be summarized as failing to understand the true nature of wealth as distinct from activity, and a failure to accurately account for known costs. We should also note what are not failures of industrial economics: competitive market allocation mechanisms, fiat currency capitalism and the promotion of innovation and technological advancement. The sustainable economic model that will serve us going forward will seek to correct the flaws and preserve the benefits of industrial economics.

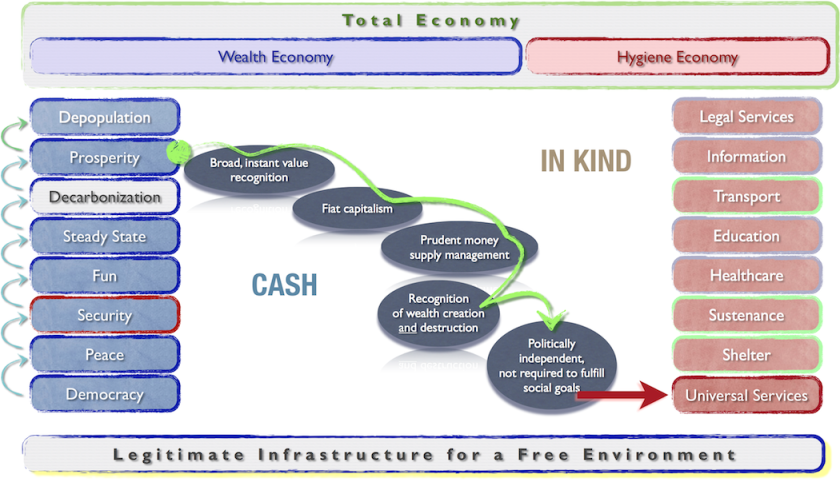

The Big Breakthrough: Wealth v. Hygiene

Our analysis of the fundamental flaws in industrial economics reveals a persistent failure to distinguish between really wealth generating activity and other activity that is truly worthwhile but not intrinsically wealth generating.

Sustainable economics incorporates this revelation through the recognition of two simultaneous economies: the wealth economy and the hygiene economy. In the wealth economy all transactions are conducted in monetary currency, whereas in the hygiene economy all transactions are in-kind. This distinction is not purposely designed or constructed, it is the outcome of a change in the way social security is provisioned. By replacing social security payments with in-kind services, the hygiene portion of activity is removed from the wealth economy.

A Brief History of TEA

Total Economic Awareness (TEA) is used in this paper to describe a philosophical framework, adopted by many people today, in which every activity is perceived as being of monetary value. It is not entirely new, King Midas had a touch of it, but it has never been so broadly adopted as it is now that it has become a defining feature of industrial capitalism. It is worth understanding a little about the evolution and development of TEA so that we can perceive it more accurately, and determine where it has infected otherwise functional systems.

TEA is essentially a completely commercial view of the world, encompassing both living things and inanimate objects. It is the “business” view of life, a mindset that sees everything as tradable and therefore worth something that can be traded for something else. In theory there is nothing wrong with this, and it is used in the theoretical study of economics; in practice, most traditions and religions warn against its adoption as a singular focus, or its use as an exclusive lens for life.

In the pre-capitalist world there were always some who adopted a TEA mindset, and they became the bankers and traders of their time and place. But their actions were always a minority of total activity, and they existing inside a wider context of other frameworks that had greater standing in their society, like religion and culture. It has only been in the last 50 years or so that TEA became such a widely adopted world view, and that is has become the definition of culture in certain societies; so much so that people refer to themselves as living is a “capitalist society”, in which economics has come to define the culture they live in. This increase has been spurred in recent decades by the adoption of fiat currencies, which have allowed so many more people to avail themselves of greater wealth. The early industrialists and oil men at the turn of the previous century adopted TEA as a brazenly deliberate approach to life, developing grand plans for their businesses in which people were simply units of resource, borrowing the dislocated condescension of the aristocracy that preceded them. They set an example of grand achievement by developing huge industrial empires and amassing great fortunes without regard to the toll extracted from the ‘resources’ they used. The damage caused by their activities was obscured by dramatic advances in production and technology, and by their industrial contributions to war efforts.

In the middle of the 20th Century, as fiat currencies replaced gold standards, the example set by the early industrialists was adopted more and more broadly by the populations of the industrialized countries, encouraged by the innate desire for competitive advantage and the apparent absence of consequences. The early TEA adopters never had to acknowledge the real support provided by their societies, which constrained their excesses and caught the fallout that they ignored. So long as the purely commercial world remained a minority of all activity and was constrained to its own sphere, the TEA mindset of a minority could not destabilize the society.

But the untrammeled pursuit of advantage through wealth has a limit, and that limit is defined by the size of the consequences that it ignores (i.e. the extent to which it is exploitative). If 20% of the consequences are unaccounted for, then 80% is the maximum TEA penetration that a society can tolerate; if 50% of the consequences are ignored, then 50% is the maximum. But the theoretical maximum TEA penetration in a society has to be modified by the amount of social support that is present by default, without any commercial activity, and that is, at a minimum, 20%, rising to 50% as the prosperity of a society increases.

The formula for determining the maximum penetration that a society can tolerate is:

Population – Default Social Need – (TEA Penetration x Exploitation Factor)

Assuming that TEA activity has a 20% exploitation factor, then the maximum penetration is 65% is an underdeveloped society with a 20% default social need

100 – 20 – (TEA Penetration x 20%) = 80-20% = 65

and 40% in a developed society with a 50% default social need

100 – 50 – (TEA Penetration x 20%) = 50-20% = 40

The absence of fiat currency in pre-industrial economies meant that TEA penetration never reached much above 10% or 20% and could easily be tolerated, even if the exploitation factor was greater than 100%. If exploitation factors reached up into the 300%-1000% range (slavery) then those activities had to be exported to remote lands (colonies) so as not to destabilize the domestic society. The domestically sanitized presentation of the wealth acquired from TEA exploitation abroad gave it a legitimacy, and allowed the domestic audience to focus more on the benefits of the greater prosperity than on the costs of the fallout from the exploitation.

The introduction of fiat currencies effectively removed most of the barriers to broad adoption of TEA and so the only limit on its growth became the tolerance capacity of the society. The concurrence of increased access to wealth resulting from fiat capitalism, and the growing dependent demography caused by increased life expectancy and greater education requirements, created a collision course between the penetration of TEA and the maximum tolerable penetration rate for TEA. It became a race for individuals to adopt TEA (commonly known as the “growth of the middle class”) before the social tolerance level was reached, meaning the point at which there would be no more room on board that bus.

Constraining the exploitation factor allows TEA to penetrate society at closer to its maximum percentage, and in the beginning of broad TEA penetration this was an almost universally adopted convention – manifested in “a growing middle class with strong labour unions and safer workplaces”. But, as the maximum potential TEA penetration approached, it didn’t take a rocket scientist to figure out that even if exploitation was reduced to zero there still wasn’t room on the bus for much more than 50% of the total population of a modern society. So some people adopted the ultimate TEA rationale, which was to increase the exploitation factor by exploiting those running to get on the bus. If there wasn’t going to be enough wealth to give everyone comparative advantage, then you’d may as well stop playing by even the most basic social rules and adopt TEA as a total philosophy, in which those who didn’t grasp the finite nature of TEA should rightly be the victims of it themselves. This final and terminal stage of TEA is where we are today, in which a small minority of TEA adherents have callously figured out that their own advantage is best acquired through the maximization of exploitation. This maximization is achieved through the deliberate obscuring of the exploitation’s effects at the same time as the cynical promotion of TEA. Examples of this terminal TEA include denying climate science while promoting consumer credit to boost wasteful product consumption, and complete destruction of Appalachian communities to produce climate destroying coal.

Related Pages

Sustainable_Economics

Functional_Capitalism

External Links

Destroying Appalachia – Mountain top removal

- ^

- Eurostats showing percentage of over 65 to those 56-64 at 25%+.

- UN statistics for worldwide demographic distribution, 2006.

- US 2010 Census says percentage of population between 20 and 65 is 60% and projected to fall to 55% by 2030.

- The average of under 15s in Europe is 17%, globally it averages 27%.

- In the US in 2010 10% of the working age population had a disability, half of whom have a job.

- 15 to 24 year olds make up another 15% of the population, and about a third of them go on to further education adding another 3%+ of the population not currently in the productive sector.

- Taken together these statistics show that developed, peaceful societies are already at a 63% Support Ratio {100% – [(15% >65yr) – (17% <15yr) – (5% non-working Disabled)]} and the percentage of over 65s expected to rise to 20%+ over the coming two decades.

- Finally, the share of the eligible population holding a job declined to 58.1% in 2011 in the US (from a high of 68% in the boom years). About 17% of total employment is provided by the government in the US (much higher in other developed countries), meaning that the entire population is supported by about one quarter of people who are in productive, non-tax funded work, with or without a boom!